It turns out that the issues surrounding QR code payments are more complex than we think.

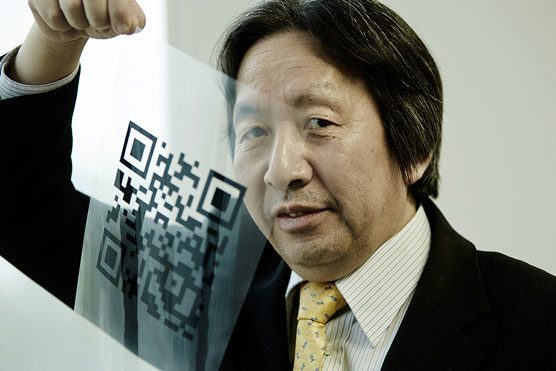

Who Invented the QR Code?

In Japan, many people often carry two wallets: a larger one for cash and credit cards, and a smaller one for coins.

For many Chinese, especially those born after 2000, this may seem quite strange since they have never owned a wallet, let alone two, from birth to adulthood.

For them, all they need when going out is a smartphone. Using QR codes, they can purchase anything from fried dough sticks to expensive watches.

QR code payments also help banks save on management costs, reduce the amount of paper currency that needs to be printed, and interestingly, a once common profession – pickpocketing – has almost disappeared in China.

But did you know that the QR code was invented by a Japanese person?

In 1994, engineer Masahiro Hara invented the QR code to assist in the management of automotive parts while he was serving as the technical director of a subsidiary of Denso, the largest automotive parts company in the world.

Not everyone knows that QR codes were invented by the Japanese.

At that time, factories were using traditional barcodes to input information, but horizontal barcodes could only contain 20 characters at a time, making it difficult to read, and employees often complained about the challenges of scanning barcodes.

This prompted Masahiro to develop a new, more user-friendly code inspired by the game of Go. As a result, his QR code increased data storage capacity by 250 times compared to traditional barcodes.

Since 2010, the QR code market in China has begun to heat up, with a slew of apps emerging, the most notable being Alipay from Alibaba and WeChat Pay from Tencent.

According to an official report in 2016, Chinese people used WeChat Pay to scan QR codes 1 billion times daily, while Alipay was used 500 million times.

The QR code payment system has nearly monopolized China’s electronic payment market, making credit and debit cards nearly forgotten, with over 80% of the population regularly using QR codes for payments.

Why Don’t the Japanese Use QR Codes for Payments?

In reality, there are still places in Japan that accept payments via QR codes through Alipay and WeChat Pay, but these are primarily aimed at Chinese tourists rather than local residents.

Why don’t the Japanese use Alipay and WeChat Pay? Many believe that using these services would allow China to access their personal information, consumption habits, and other data.

Moreover, Alipay and WeChat Pay also present barriers for the Japanese. They must use bank cards from Chinese financial institutions, and since Japanese people do not have identification or mobile phone numbers in China, they cannot register.

However, these are not the real reasons.

The fact is that the Japanese began adopting credit cards in the 1970s, and over the past half-century, Japanese society has established a highly developed system for issuing, evaluating, and using credit cards.

Japanese people began owning credit cards in the 1970s. (Illustrative image).

A typical Japanese individual starts spending by applying for a regular card, and after several years of good credit history and application, they may receive an increase in their limit and even upgrade to gold or platinum cards.

The type of credit card a Japanese person possesses correlates with their creditworthiness.

This ratio serves as the safest risk control measure for credit card issuers.

In contrast, the development of credit cards in China has been minimal because before it matured, QR codes had already proliferated. This payment system does not require credit assessments and only requires a top-up.

It can be said that the differing conditions in each country lead to various forms of electronic payments, along with distinct social issues and concerns. There are pros and cons to everything.