As soon as China restricts the export of this “diamond,” foreign electric vehicle manufacturers will face severe impacts.

Despite billions of dollars in investments from the West, China continues to advance in the field of rare mineral extraction, engineering training, and constructing massive factories. By 2030, it is estimated that China will produce twice as many batteries as all other countries combined, according to estimates from the consulting group Benchmark Minerals.

Electric vehicles use approximately six times more rare minerals compared to conventional cars, and China currently has the power to decide who gets to purchase first and at what specific prices. Although the country has few underground raw material mines, it pursues a long-term strategy to secure a cheap and stable supply. Chinese companies, supported by the government, also acquire stakes in numerous mining companies to quickly gain control over supply.

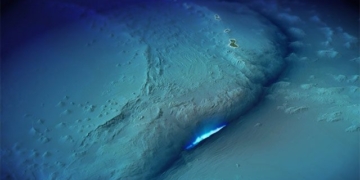

According to The New York Times, China owns most of the cobalt mines (also known as blue diamonds) in the Democratic Republic of Congo – which supplies the majority of the scarce materials needed for the world’s most popular batteries. American companies have struggled to keep pace and have even sold mines to Chinese partners. As a result, China controls 41% of cobalt mining operations globally and has the largest lithium extraction – a critical component for electric vehicle batteries.

“We must give credit where it’s due. They have been investing money long before anyone else had the intention,” said Hadley Natus, President of Tantalex, a lithium mining group in the Democratic Republic of Congo.

Last year, fearing that China would acquire a significant amount of pure cobalt, the Democratic Republic of Congo even aimed to increase its stake in a joint venture with Chinese companies to 70% from 32%. The goal was to gain more control over the Sicomines joint venture, which is currently dominated by Chinese companies.

“It is estimated that 90% of the Democratic Republic of Congo’s mineral exports go to China, while the contribution of this sector to the country’s GDP does not exceed 30%,” said Jean-Pierre Okenda, Director of Resource Matters mining industry.

According to a report from Darton Commodities, China is ready to strengthen its control over the global cobalt supply. By 2025, the market share of cobalt production in China could reach half of the global output.

China is the only country capable of self-sufficiency in the electric vehicle battery supply chain.

As of mid-2023, Chinese companies such as Chengtun Mining, China Molybdenum, CMOC, Wanbao, and Jinchuan own up to 15 out of 19 mining assets in the Democratic Republic of Congo, including some of the largest mines in the world like Tenke Fungurume and Sicomines. These two mines alone account for 20% of global cobalt production.

In addition to the Democratic Republic of Congo, Chinese companies are also gradually shifting their focus to Indonesia to boost cobalt extraction and build refining plants. They are also integrating nickel processing and cobalt recovery from ores.

Thanks to controlling the majority of cobalt, lithium, and many other rare minerals, China is the only country capable of self-sufficiency in the electric vehicle battery supply chain. No other country has reached this level, no matter how cheap labor may be. Eventually, they will have to find ways to establish partnerships with Chinese manufacturers to participate or expand within the industry, according to Scott Kennedy, a senior advisor at C.S.I.S.

“The first wave of Chinese investment has occurred, and that serves as a warning bell for Western companies,” said Anthony Viljoen, CEO of Andrada, to the Financial Times.

Experts say that China’s supply chain has an “addictive quality” because most international car manufacturers need affordable batteries to compete. This battery market is expected to quadruple to $693.70 billion by 2030, up from $193.55 billion in 2022.

“This presents a dilemma for American automakers,” said Yang Jing, Director of Asia-Pacific Corporate Research at Fitch. “The U.S. realizes that China dominates the entire supply chain. If they only sell electric vehicles without building their own supply chain, their dependence on Chinese companies remains significant.”

China’s control over a large portion of the world’s minerals gives it the ability to disrupt the energy transition and chip production, especially amidst geopolitical tensions with the U.S. If China restricts the export of lithium or cobalt, foreign electric vehicle manufacturers will suffer severe consequences.

According to the WSJ, China’s imposition of large-scale regulations on minerals is akin to forcing the U.S. to experience similar significant impacts as the oil embargo of 1973. At that time, long lines formed at gas stations as the global economy was in turmoil.

Currently, Western countries also own some mineral mines and are trying to catch up with China, but experts suggest that nearly everything will ultimately need to be processed in China. Such processes consume a significant amount of energy; however, with government support in terms of land and cheap energy, Chinese companies have been able to refine minerals on a much larger scale at significantly lower costs than those in other countries.