The practice of buying and selling goods and making payments online has become indispensable in the e-commerce marketplace. However, in Vietnam, businesses still struggle to participate in this arena.

The inability to process online payments not only impacts the business operations of companies but also results in significant tax revenue losses for the government, adversely affecting the country’s reputation.

Companies at a Disadvantage

|

| In Vietnam, many online shopping websites have emerged, but operations are still stalled due to the lack of merchant accounts, making transactions with foreign customers difficult. Photo: Nguyễn Sa |

Currently, Vietnamese individuals who want to sell goods online cannot apply for a Merchant Account. Ms. Nguyễn Thùy Vũ, Director of Online Company (which owns the online shopping website thegioihoatuoi.com), states: “The demand for online payment among Vietnamese businesses is very high, especially as we aim to expand our transactions globally. However, Vietnamese companies cannot open Merchant Accounts to facilitate transactions with customers effectively. We have lost many foreign customers just because we lack a Merchant Account.”

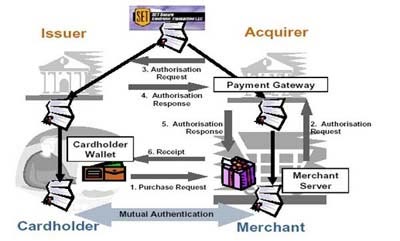

| Online Payment Process |

| 1. Customers visit the online shopping website to place orders and enter their credit card information. 2. Customer information is sent directly to the seller’s bank if the seller has a Merchant Account; if not, the information is forwarded to a third party, a payment processing service provider that the seller has registered with. Customer information is not stored on the seller’s server, reducing the risk of credit card information theft. 3. The seller’s bank or the third party verifies the validity of the customer’s credit card information via a Secure Electronic Transaction. This process takes only a few seconds. 4. The card-issuing bank responds to the bank that requested the validity check (the information is encrypted). 5. This information is then decrypted and sent back to the seller. 6. The seller decides whether to sell based on this information and sends an email to the customer to notify them if their order has been accepted and processed. 7. The selling business sends an invoice to the buyer and delivers the goods. (According to vitanco.com) |

This is not an isolated complaint from one company. According to Mr. Trần Thanh Hải, Deputy Director of the Department of E-commerce: “In my work with businesses, many have expressed concerns about this issue. Numerous companies have prepared everything for their online business plans but have had to delay due to payment processing issues.”

Mr. Hải further noted that the inability of Vietnamese companies to open Merchant Accounts is beyond the Department of E-commerce’s ability to resolve. “This is a banking issue. I also hope that the State Bank will soon make decisions so that Vietnamese businesses can easily participate in the international marketplace. This obstacle not only disadvantages businesses but also slows the growth of Vietnam’s e-commerce sector,” Mr. Hải added.

As per Mr. Hải’s advice, while companies temporarily cannot open Merchant Accounts, they can seek alternative methods such as finding third-party services. However, many businesses in the e-commerce sector find that even using third-party services is not stable.

No Options Available

Some companies opt to have relatives or friends in the United States, Thailand, or other countries open Merchant Accounts to meet international payment needs. “This choice carries risks and inconveniences for the person who opens the account, such as having to declare income for tax purposes in their country, and their personal information being exposed online is also a disadvantage for them,” said Mr. Alain Nguyễn, an online industry participant.

Some companies have to resort to using third-party service providers like PayPal, WorldPay, and 2Checkout. Notably, PayPal, WorldPay, Google Checkout, and several other reputable organizations have outright refused to work with Vietnamese sellers.

Only a few providers, like 2Checkout, are willing to accept Vietnamese businesses, but they do not offer support in Vietnamese or technical assistance, which means only clients who are technical staff skilled in web programming and fluent in English can successfully transact with them.

Ms. Thùy Vũ further shared: “When I couldn’t open a Merchant Account, I had to choose 2Checkout. The registration process took nearly a month and cost about 50 USD, but my company still cannot use this service. Initially, I thought they would provide support to help us connect payment on our website after receiving payment, but after they got the money, they showed no interest in whether we could use it or not. Their support service only offers lengthy FAQs in English, and I never received a response to my emails. Moreover, if we do manage to use the service, there are still commission fees and complex terms to comply with, benefiting them only.”

It is known that many selling companies are dissatisfied with third-party services because these providers do not prioritize the interests of the businesses. Specifically, when a customer places an order on a website but later changes their mind, resulting in a failed transaction, the seller neither makes a sale nor avoids transaction fees with the third party.

Online Payment in Vietnam: When Will It Happen?

|

Online payment processing flow (Source: Richard Jewson. E-Payments: Credit Cards on the Internet) |

We have contacted the Banking Information Technology Department (State Bank) several times to understand why, to this day, the bank has not been able to assist Vietnamese businesses in opening Merchant Accounts, but we could not meet with the department leaders (Director, Deputy Director), and subordinate staff were unable to provide answers.

In today’s competitive business environment, companies urgently need effective transaction tools to support operations, such as online payments, yet they cannot actively engage in this area.

Moreover, without state management measures, there could be significant tax revenue losses if businesses choose to have intermediaries open accounts abroad. Furthermore, facilitating the e-commerce marketplace is also a way to affirm the position of Vietnamese brands and integrate into the global arena.

Nguyễn Sa