Taxes have existed longer than we think. In ancient times, if people lacked money, they had to pay taxes in kind.

Every April, signs of spring begin to appear in the United States, such as flowers blooming, birds chirping, and the annual tax announcement.

Taxes have existed for thousands of years and have been applied in various forms. (Photo: Bible History).

For many, paying taxes is a source of dread, and this fear is not new; it dates back thousands of years.

For centuries, governments around the world have taxed everything, even urine and facial hair. If people were unable to pay taxes in cash, they could substitute with beer, beds, and brooms. All collected taxes were used to fund government projects and services, from building pyramids to maintaining armies.

Paying Taxes with 7 Barrels of Beer

According to National Geographic, taxes existed before coins were introduced. Taxes were levied on everything and could be paid with a variety of items, not just money.

Taxes originated from ancient Mesopotamia. (Photo: Alamy Stock Photo).

In ancient Mesopotamian civilization, the flexibility of tax payments made it rather unusual.

For example, the tax on burying a deceased person included 7 barrels of beer, 420 loaves of bread, 2 bushels of barley, a woolen garment, a goat, and a bed.

Historian Tonia Sharlach from Oklahoma noted that around 2000-1800 BC, the tax record was 18,880 brooms and 6 logs.

Due to excessive taxation, many people in ancient times sought ways to evade taxes. For instance, one man claimed he owned nothing but extremely heavy millstones, which the tax collector was forced to take.

Taxed Before Making Money

In ancient Egypt, this was one of the first civilizations with an organized tax system. Around 3000 BC, shortly after Pharaoh Narmer unified Upper and Lower Egypt, this tax system began to emerge.

Researchers indicate that Egypt’s early rulers were keenly interested in taxation. They traveled throughout the country with entourages to assess the wealth of the people—from oil, beer, pottery to livestock and crops—and taxed everything.

At that time, the annual taxation event was known as Shemsu Hor, or Following of Horus.

During the Old Kingdom of Egypt, taxes were so substantial that they were sufficient to build large structures, such as the pyramids at Giza.

The tax system of ancient Egypt evolved over a 3,000-year span, becoming more complex over time.

By the New Kingdom period (approximately 1539-1075 BC), rulers sought to tax the populace based on what they produced, before those products were sold.

To tax in this manner, officials used an invention called the nilometer. This device measured the water level of the Nile during the annual floods.

If the water level was low, taxes would be reduced, indicating drought and poor harvests. Conversely, if the water rose high, indicating a bountiful harvest, the people would face higher taxes.

Tax Exemptions for Good Ideas

The Mauryan Empire in India, around 321-185 BC, devised a tax amnesty for the people through an annual competition, where the winner would be exempt from taxes.

Specifically, each year, the government invited citizens to propose solutions to the nation’s problems.

“If your solution is chosen and implemented, you will be tax-exempt for the rest of your life,” Greek writer and historian Megasthenes expressed his astonishment at this tax exemption method in India.

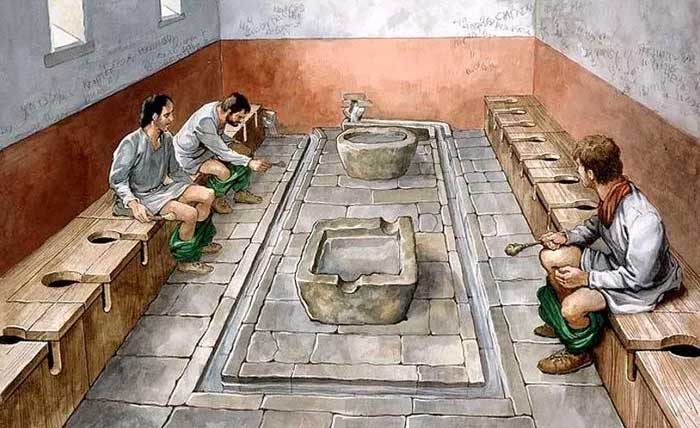

Ancient Rome imposed a tax on urine because the ammonia in urine had many benefits. (Photo: Ancient Origins).

In ancient Rome, Emperor Vespasian brought stability during a chaotic period, partly due to his unique tax reform—taxing urine.

Ammonia was a valuable commodity in ancient Rome because it was effective in cleaning dirt and grease from clothes. Additionally, urine was used in leather production, fertilizer, and even teeth whitening.

All ammonia came from human urine, mostly collected from public toilets in Rome. Recognizing the benefits of urine, the Romans found a way to tax it.

However, not everyone supported Emperor Vespasian’s urine tax. Wealthy individuals, including his son Titus, vehemently opposed the urine tax.

According to historian Suetonius, Titus told his father that he found the urine tax disgusting, to which Vespasian replied, “Pecunia non olet,” meaning “Money has no smell.”

Many Odd Taxes

During the flourishing 15th and 16th centuries, the Aztec Empire became wealthy through taxation. Historian Michael E. Smith studied this taxation system and found it to be more complex than many others.

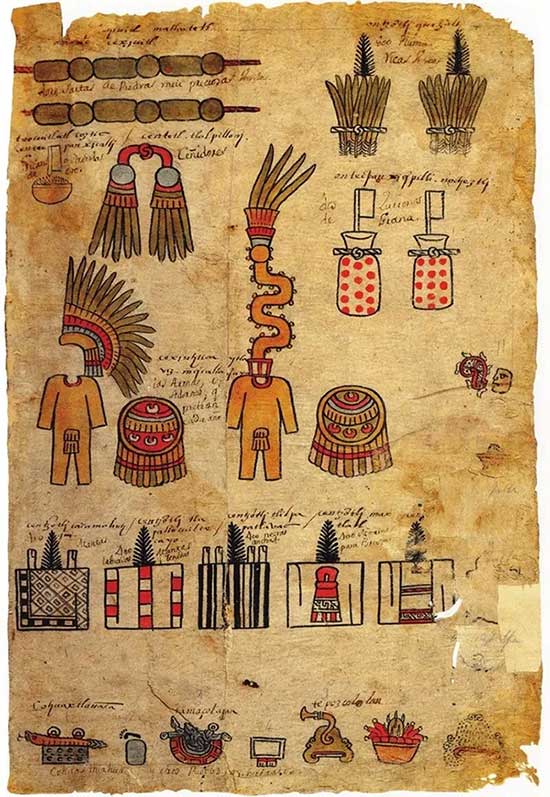

The Matrícula de Tributos records the tax history of the people. (Photo: ResearchGate).

Taxes were collected by various levels of government, with different forms of taxation, but ultimately, they were all sent to the central administration of the Aztecs.

Here, they meticulously stored records of tax payments, with many documents still existing today.

The most famous is the Matrícula de Tributos, a colorful record detailing the tax contributions of the citizens.

This document is filled with colorful hieroglyphs, indicating how many jaguar skins, corn, cacao, and even gold, honey, salt, textiles… were submitted by the people.

Russia also had some peculiar tax practices. In 1698, Peter the Great mandated that men in the country shave their beards to resemble the modern nations of Western Europe – which he considered “modernization.”

To encourage compliance with the shaving regulation, he decided to tax those who preferred to keep their beards. Thus, Russian men wishing to keep their beards had to pay a tax. Peasants paid a lower beard tax, while nobles and merchants could be taxed up to 100 rubles (approximately $1.07 today).

Those who paid the tax were also required to carry a badge to prove they had paid. However, the beard tax did not last long. By 1772, Catherine the Great officially abolished this peculiar tax.