Recently, many banks in Vietnam officially notified users that magnetic stripe ATM cards will no longer be supported and will not be accepted at transaction points nationwide, according to Circular 41/2018/TT-NHNN from the State Bank of Vietnam. To enhance security for customers, starting from March 31, 2021, banks have ceased the issuance of old magnetic stripe ATM cards and completely replaced them with new chip cards.

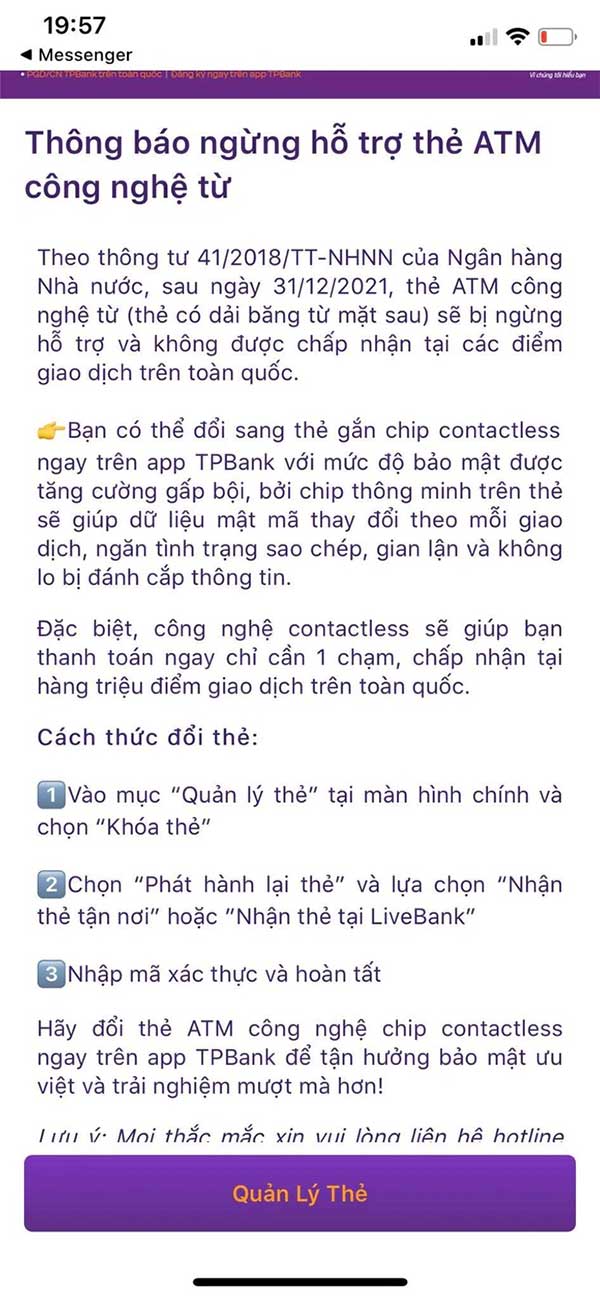

Many banks have begun notifying the discontinuation of magnetic stripe ATM cards.

Many users have expressed confusion as to why it is necessary to eliminate magnetic stripe ATM cards in favor of chip cards, especially since this transition requires additional manpower and time for a complete switch…

The answer lies in the security of chip cards.

This is a magnetic stripe ATM card with a magnetic stripe on the back.

Current banks and many experts indicate that the transition from magnetic stripe ATM cards to chip ATM cards will enhance security levels, transaction speed, safety, and ensure customer rights. Before chip ATM cards became widely adopted, cases of information theft from cards to access bank account funds frequently occurred with magnetic stripe ATM cards, which have a low security level.

Magnetic stripe cards store all personal information of customers after the black stripe on the card in text format. This information is easily susceptible to encryption and theft when customers insert their cards into ATMs or swipe them on POS machines; the information stored on the magnetic stripe can be read by the readers in the machines. Therefore, with just a common magnetic stripe card reader, thieves can easily steal card information and subsequently create counterfeit cards with the copied information, while also attaching devices to secretly record customers’ PIN entry actions, thus enabling them to steal money from customers’ accounts.

Information on the card can be easily stolen when users perform transactions.

Thus, users should remember that after December 31, 2021, magnetic stripe cards will not be usable nationwide, even for withdrawing cash at ATMs. Users should register soon to receive chip cards as soon as possible.

Additionally, users need to keep the following points in mind to protect their chip ATM cards:

- Do not keep chip cards near sharp objects like knives, etc., and store them in a soft wallet to avoid damaging the chip.

- Do not bend or twist the card, as this may distort the information due to the electronic circuits inside the chip.

- Store the card in a place at normal temperature, as the card is made of hard plastic and can quickly deteriorate in unsuitable conditions.

Moreover, to avoid excessive fees when conducting transactions with chip cards, you should pay attention to the following:

- Withdraw cash at ATMs within the system to reduce costs.

- Transfer funds within the system via ATMs.

- Chip cards can be used for online shopping globally.

- The annual maintenance fee for chip cards may be higher than that of magnetic stripe cards, depending on each bank.

Why do Japanese people sleep on the floor? You won’t believe the answer!