Many people have been using ATM cards from banks for a long time but are still unclear about the type of card they are using and the level of security it offers.

Recently, the State Bank of Vietnam (SBV) announced that it will stop issuing magnetic stripe ATM cards from March 31, 2021, and will completely replace them with chip cards. However, many users are still confused and unable to distinguish the differences between these two types of cards.

What is a Magnetic Stripe Card?

A magnetic stripe card has a relatively low level of information security because the information stored on the magnetic stripe on the back of the card is not encrypted.

The difference between magnetic stripe ATM cards and chip cards.

When customers insert their card into an ATM or swipe it on a POS machine, the personal information stored on the black magnetic stripe at the back will be read by the machine’s readers. Therefore, with a common magnetic stripe reader available on the market, fraudsters can easily steal card information.

After that, they can easily create counterfeit cards using the copied information and also attach devices that secretly record the customer’s PIN entry. With this relatively simple method of appropriation, fraudsters can steal money from customers’ bank accounts. This is a very common form of property theft today.

What is a Chip Card?

A chip card is a debit or credit card that is the same size as a regular ATM card and contains a chip located on the front of the card.

This chip encrypts information to enhance data security when conducting transactions at card swipe machines in stores or ATMs. Chip cards are international payment cards, which allows transactions to be conducted globally, adding an advantage to this type of card.

Chip ATM card.

Currently, many Vietnamese banks offer international credit and debit cards equipped with chips, such as VIB, VietinBank, VietcomBank, Techcombank, ACB, Sacombank, Nam Á Bank, etc.

In addition, chip cards available in the market also come with contactless payment features to enhance security and minimize physical contact with personal ATM cards.

To make a payment for a transaction, you only need to tap the card on the card reader, without the need to hand it to the staff or insert the chip into the machine.

Contactless cards will have a wave symbol next to the chip, which is an indicator for you to recognize if your ATM card can make contactless payments.

Moreover, from March 31, 2021, banks will be required to completely transition to chip cards for the security and safety of customers.

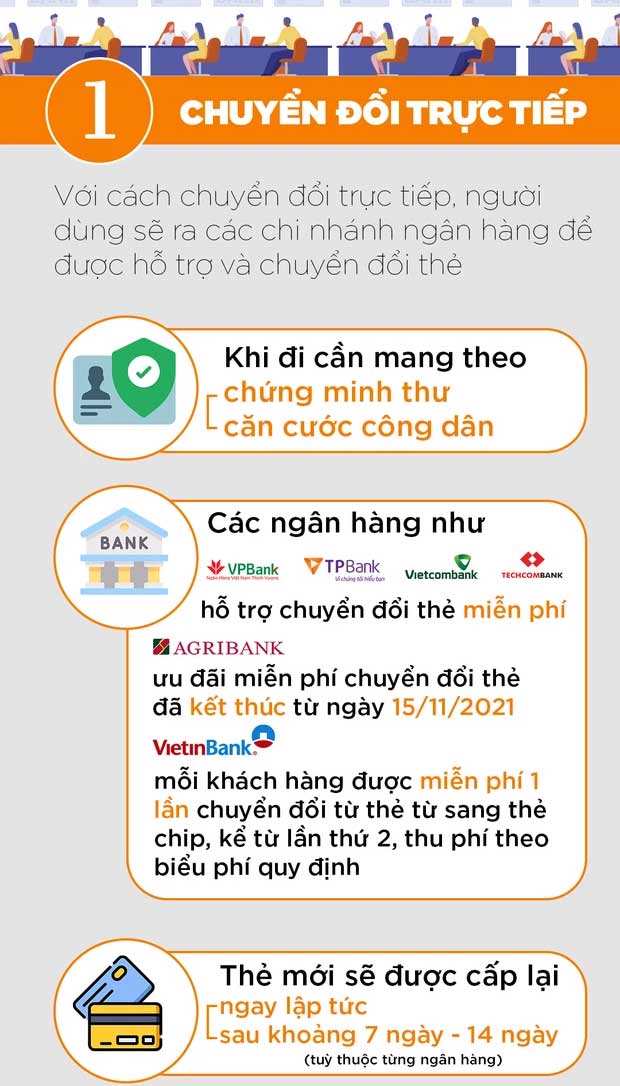

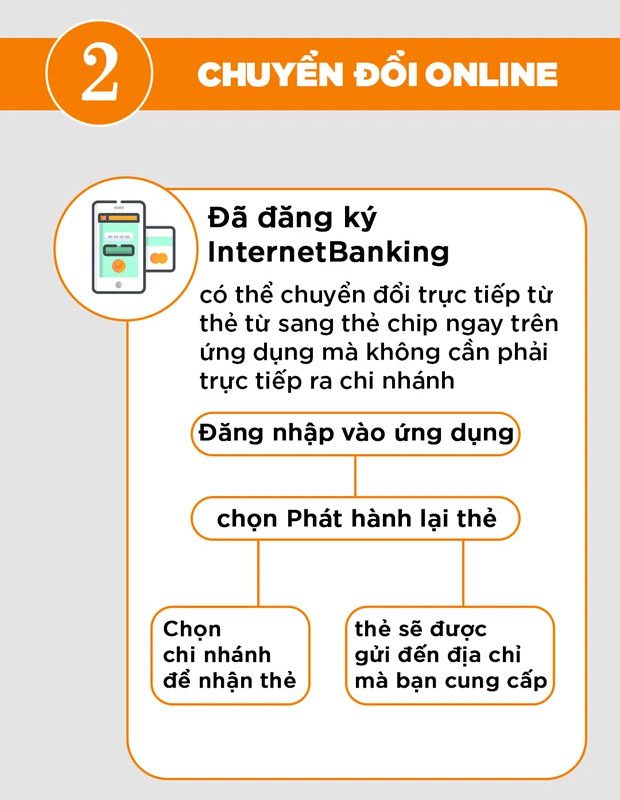

Guide to Switching from Magnetic Stripe Cards to Chip Cards